This white paper addresses the following openfunds fields:

| OFID | openfunds | ID | Value | Type | Risk | TPT |

| OFST010020 | Legal Fund Name Including Umbrella | ✓ | ✓ | |||

| OFST010410 | Fund Currency | ✓ | ||||

| OFST020000 | ISIN | ✓ | ✓ | |||

| OFST020010 | Valor | ✓ | ||||

| OFST020015 | WKN | ✓ | ✓ | |||

| OFST020040 | SEDOL | ✓ | ✓ | |||

| OFPH000010 | Holding as at Date | ✓ | ✓ | |||

| OFPH000020 | Portfolio Currency | ✓ | ✓ | |||

| OFPH000030 | Holding Level | ✓ | ✓ | |||

| OFPH000050 | Portfolio Duration | ✓ | ✓ | ✓ | ||

| OFPH000060 | Portfolio Liquidity | ✓ | ✓ | |||

| OFPH000100 | Holding ISIN | ✓ | ✓ | |||

| OFPH000110 | Holding WKN | ✓ | ✓ | |||

| OFPH000120 | Holding Valor | ✓ | ||||

| OFPH000130 | Holding Ticker | ✓ | ✓ | |||

| OFPH000135 | Holding MIC | ✓ | ✓ | |||

| OFPH000140 | Holding SEDOL | ✓ | ✓ | |||

| OFPH000145 | Holding CUSIP | ✓ | ✓ | |||

| OFPH000150 | Holding APIR Code | ✓ | ✓ | |||

| OFPH000155 | Holding Bloomberg Ticker | ✓ | ✓ | |||

| OFPH000160 | Holding SIC Code | ✓ | ||||

| OFPH000165 | Holding NAICS Code | ✓ | ||||

| OFPH000170 | Holding FIGI | ✓ | ||||

| OFPH000175 | Holding CFI Code | ✓ | ||||

| OFPH000180 | Holding EUSIPA Product Category | ✓ | ||||

| OFPH000190 | Holding Other Identifier | ✓ | ✓ | |||

| OFPH000195 | Holding Other Identifier Type | ✓ | ✓ | |||

| OFPH000200 | Holding Name | ✓ | ✓ | |||

| OFPH000205 | Holding Grouping Code | ✓ | ✓ | ✓ | ||

| OFPH000210 | Holding Instrument Type | ✓ | ||||

| OFPH000215 | Holding CIC | ✓ | ✓ | |||

| OFPH000250 | Holding Market Value in Portfolio Currency | ✓ | ✓ | ✓ | ||

| OFPH000255 | Holding Market Value in Holding Currency | ✓ | ✓ | ✓ | ||

| OFPH000260 | Holding Clean Market Value in Portfolio Currency | ✓ | ✓ | ✓ | ||

| OFPH000270 | Holding Market Exposure in Portfolio Currency | ✓ | ✓ | ✓ | ||

| OFPH000275 | Holding Market Exposure in Holding Currency | ✓ | ✓ | ✓ | ||

| OFPH000280 | Holding Market Exposure in Weight | ✓ | ✓ | ✓ | ||

| OFPH000290 | Holding Contract Size | ✓ | ✓ | ✓ | ||

| OFPH000300 | Holding Net Weight as Percentage | ✓ | ✓ | |||

| OFPH000400 | Holding Currency | ✓ | ✓ | ✓ | ||

| OFPH000410 | Holding NACE Code | ✓ | ✓ | |||

| OFPH000420 | Holding Risk Country | ✓ | ||||

| OFPH000430 | Holding Asset Class | ✓ | ||||

| OFPH000435 | Holding GICS Classification Code (1) | ✓ | ||||

| OFPH000440 | Holding Credit Rating | ✓ | ✓ | ✓ | ||

| OFPH000445 | Holding Credit Rating Agency | ✓ | ✓ | ✓ | ||

| OFPH000450 | Holding Number of Shares | ✓ | ✓ | |||

| OFPH000452 | Holding Price in Portfolio Currency | ✓ | ||||

| OFPH000455 | Holding Price in Holding Currency | ✓ | ||||

| OFPH000457 | Holding Dividend Yield | ✓ | ||||

| OFPH000460 | Holding Coupon Rate | ✓ | ✓ | |||

| OFPH000465 | Holding Modified Duration | ✓ | ✓ | |||

| OFPH000467 | Holding Effective Duration | ✓ | ||||

| OFPH000470 | Holding Nominal Amount | ✓ | ✓ | |||

| OFPH000480 | Holding Maturity Date | ✓ | ✓ | ✓ | ||

| OFPH000482 | Holding Effective Maturity Date | ✓ | ✓ | |||

| OFPH000485 | Holding Yield to Maturity | ✓ | ✓ | |||

| OFPH000487 | Holding Yield to Worst | ✓ | ||||

| OFPH000490 | Holding Bond Floor | ✓ | ✓ | |||

| OFPH000495 | Holding Option Premium | ✓ | ✓ | |||

| OFPH000500 | Holding Delta Adjusted Exposure | ✓ | ||||

| OFPH000510 | Holding Option Adjusted Spread | ✓ | ||||

| OFPH000520 | Holding Effective Spread Duration | ✓ | ||||

| OFPH000600 | Holding Interest Rate Type | ✓ | ✓ | ✓ | ||

| OFPH000605 | Holding Interest Rate Reference ID | ✓ | ✓ | ✓ | ||

| OFPH000610 | Holding Interest Rate Index ID Type | ✓ | ✓ | ✓ | ||

| OFPH000615 | Holding Interest Rate Index Name | ✓ | ✓ | ✓ | ||

| OFPH000620 | Holding Interest Rate Margin | ✓ | ✓ | |||

| OFPH000625 | Holding Coupon Payment Frequency | ✓ | ✓ | |||

| OFPH000630 | Holding Redemption Type | ✓ | ✓ | ✓ | ||

| OFPH000635 | Holding Redemption Rate | ✓ | ✓ | ✓ | ||

| OFPH000640 | Holding Callable Putable | ✓ | ✓ | ✓ | ||

| OFPH000645 | Holding Call Put Date | ✓ | ✓ | |||

| OFPH000650 | Holding Issuer Bearer Option Exercise | ✓ | ✓ | |||

| OFPH000655 | Holding Strike Price for Embedded Options | ✓ | ✓ | |||

| OFPH000700 | Holding Issuer Name | ✓ | ✓ | |||

| OFPH000710 | Holding Issuer LEI | ✓ | ✓ | ✓ | ||

| OFPH000711 | Holding Issuer LEI Registration Status | ✓ | ✓ | |||

| OFPH000712 | Holding Issuer Domicile | ✓ | ✓ | |||

| OFPH000715 | Holding Subordinated Debt | ✓ | ✓ | ✓ | ||

| OFPH000720 | Holding Nature of Tranche | ✓ | ✓ | ✓ | ||

| OFPH000725 | Holding Credit Quality Step | ✓ | ✓ | |||

| OFPH000730 | Holding Strike Price | ✓ | ✓ | |||

| OFPH000735 | Holding Effective Date | ✓ | ✓ | |||

| OFPH000740 | Holding Exercise Type | ✓ | ✓ | ✓ | ||

| OFPH000745 | Is Index Holding | ✓ | ✓ | |||

| OFPH000750 | Is Holding Loss Absorbing Security | ✓ | ✓ | |||

| OFPH000800 | Holding Underlying Asset CIC | ✓ | ✓ | ✓ | ||

| OFPH000805 | Holding Underlying Asset ISIN | ✓ | ✓ | ✓ | ||

| OFPH000810 | Holding Underlying Asset WKN | ✓ | ✓ | ✓ | ||

| OFPH000815 | Holding Underlying Asset Ticker | ✓ | ✓ | ✓ | ||

| OFPH000820 | Holding Underlying Asset Valor | ✓ | ✓ | |||

| OFPH000850 | Holding Underlying Asset Name | ✓ | ✓ | ✓ | ||

| OFPH000855 | Holding Underlying Asset Currency | ✓ | ✓ | ✓ | ✓ | |

| OFPH000860 | Holding Underlying Asset Coupon Rate | ✓ | ✓ | ✓ | ||

| OFPH000865 | Holding Underlying Asset Coupon Payment Frequency | ✓ | ✓ | ✓ | ||

| OFPH000870 | Holding Underlying Asset Maturity Date | ✓ | ✓ | ✓ | ||

| OFPH000900 | Holding Original Portfolio ID | ✓ | ✓ | ✓ |

Table 1: Fields defined by openfunds, relating to Full Portfolio Holdings

(1) renaming of field as per openfunds field version 2.13.0; previous field name “Holding GICS Sector Code”

Introduction

While most openfunds fields describe specific attributes of a fund, these ‘Full Portfolio Holding’ (FPH) fields investigate the fund and provide information on a more granular level, the fund’s investments.

Apart from ‘Fund Ratios and Exposures’ there are only few relations into other openfunds field categories. Therefore, openfunds has introduced a separate set of fields, which can be recognized by the ‘OFPH’ prefix.

There is another difference to other openfunds field areas. While others, like portfolio managers (OFPM), dynamic data (OFDY) or regulatory data (OFEM, OFEP) usually intend for a clearly defined purpose and therefore ask for a quite fixed set of fields, the need for full portfolio holding data depends on the purpose.

Different purposes for Full Portfolio Holdings

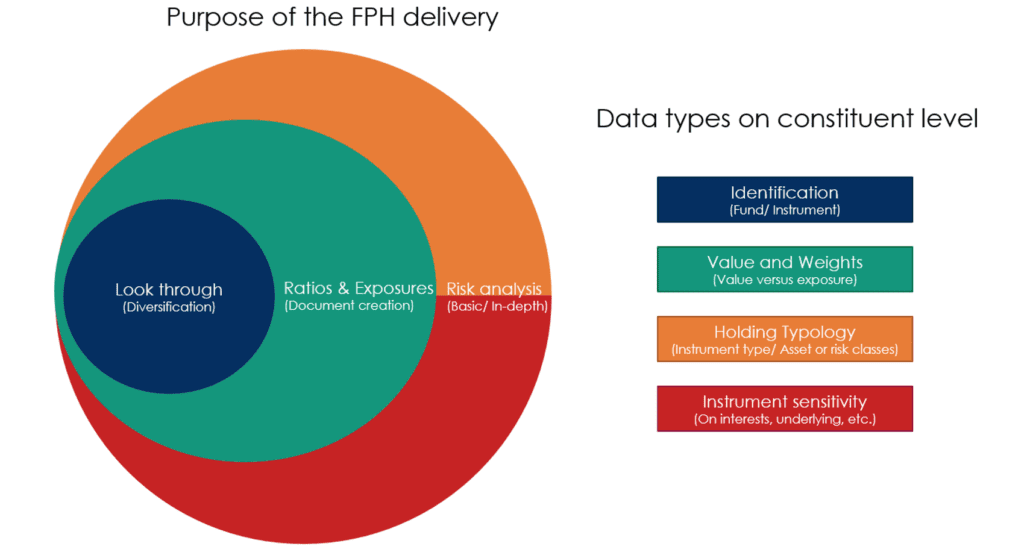

This section and Figure 1 below describe three exemplary use cases for full portfolio holdings information. Certainly, there are more, however, these three scenarios were those considered by the openfunds FPH working group in 2021/2022.

Look through

Assume a portfolio consisting of stocks, bonds, cash, and funds. There might be a need to look through the fund into its single investments as they might complement or overlap with the portfolio’s direct investments. Private banks might want to provide that look through to their clients to provide an improved transparency.

ESG, ‘Environmental, Social, and Governance’ purposes also require that information, as investors might want to know the ultimate investment for their own ESG analysis. Very often, fund companies already provide ESG data on an aggregated level for their funds, which gives a good, but summarized ESG insight into their single funds. Yet, for risk purposes, certain investors have the need to drill down deeper into the characteristics of the individual constituents.

For the purpose of a look-through, the bare minimum requirement is no more than an identifier. The recipients of a FPH file then can match the constituents’ identifier with their own instrument database. Although the ISIN represents the broadest acceptance amongst fund industry participants, openfunds also provides additional identifying fields as there are instrument types and jurisdictions where different identifiers are the norm.

Calculation of Fund Ratios and Exposures

The white paper “Fund Ratios and Exposures” outlines the most commonly used ratios for fund evaluation and comparison. These ratios are typically published in periodically distributed fact sheets that provide investors with regular updates.

The calculation of these numbers is based on the fund constituents’ data, which usually include values, weights and additional information like currencies, number of shares etc., which can be used for checks and foreign currency conversion.

When a fund uses derivatives, delta-adjusted values of the market exposure should be applied instead of the instruments’ market value. Derivative instruments such as swaps should be reported as two separate lines, representing their respective legs (“two leg approach”).

If the sole purpose of delivering full portfolio holdings is to support the calculation of fund ratios and exposures, it may be more efficient to provide the pre-calculated data as specified in the aforementioned white paper “Fund Ratios and Exposures”.

Risk analysis

There are a variety of different risk analysis that can be run on a fund portfolio. Normally the asset manager will buy some specialized software or even develop his own proprietary software to solve this task. Also, the size of necessary input data is closely linked to the kind of risk analysis and can be huge. Therefore, it is difficult to define one fix dataset that can be used for all kind of risk analysis on the recipient’s side, as it depends on the use case.

The suggested set of fields for risk analysis follows two rules:

- The number of fields should be kept to a reasonable minimum.

- It should use existing data fields from acknowledged data standards instead of creating new ones. Therefore, fields from the most recent Tripartite Template version (TPT) that can be found on FinDatEx’s webpage (www.findatex.eu) was used whenever possible. were used whenever possible. For further explanation please see below in “Difference to the TPT and limitations”.

Therefore, openfunds proposes a practical set of data fields defined by a working group of fund experts in 2021/22. The dataset is intended as a best-practice standard and is based on file formats that were in use at the time of the working group’s discussions. The scope of the dataset can be expanded in the future through a newly established working group to address evolving market or regulatory needs.

Link between purpose and necessary fields

Figure 1: The purpose of FPH delivery and the associated data types

The size of the circles represents the number of fields necessary to fulfil the purpose.

It is important to get a mutual understanding of the FPH’s delivery purpose between data sender and data recipient, as not only the number of fields may increase, but also the complexity of the needed data fields will increase substantially.

While the number of required fields and the complexity already are good reasons to decide whether a reduced number of fields might be sufficient for the required purpose, data confidentiality is another one. For the professional management of big portfolios, data confidentiality can be crucial especially if the portfolio includes positions with a reduced market liquidity or with a high price sensitivity. Therefore, full portfolio data information usually is distributed not before the end of an embargo period or only after the recipient has agreed to a non-disclosure agreement (NDA) or both.

Common embargo periods depend on the holdings held within the portfolio. While for a traditional bond, equity, or mixed portfolio an embargo of 30 days seems reasonable, this period can be prolonged to 3 or even 6 months if the portfolio contains illiquid positions or big positions in narrow markets.

The colour coding of fields in the table at the beginning of this whitepaper gives an indication which fields are needed for any of the three listed purposes.

Difference to the TPT and limitations

With the EU solvency regulation which entered into force in 2016, a European working group created the tripartite template (TPT). The most current version is version 7, released in November 2024. It includes 148 fields, which are used to perform calculations of risk exposures that are required by European insurance companies for their investments. The TPT standard contains direction on which fields must be provided for each instrument type and contains 94 fields that are mandatory or conditional for at least one instrument type.

Considering the depth of information asset managers usually ask for NDA’s and insist on longer embargo periods for this information. The intent of the openfunds FPH dataset is to be more lightweight and flexible, to be used for other use cases outside of Solvency II reporting. However, the TPT is common to European asset managers if their funds are bought by insurance companies, so the openfunds FPH solution uses existing TPT fields when it is appropriate and adopts naming and values to its own standards in order to offer direct mapping between the two wherever possible (see Table 1, illustrating the mapping to the TPT).

The main differences to the TPT are:

- Reduced set of fields

- Field name and value adoption to openfunds conventions

- Multipurpose approach

- Individual field descriptions

Derivatives and Swaps

For a deep risk analysis, a good understanding of the derivatives’ behaviour within the portfolio is crucial. While for look-through purposes the market value of the derivative (the amount of money one would receive when selling the derivative, also called the total amount invested in that derivative) might be sufficient, this might not be the case for the risk analysis where the market exposure, also called notional value, is more appropriate. Usually, the market exposure or notional value for options, futures and forwards is much higher than the derivative’s market value. Put in other words, the derivative’s market value equals the total amount invested into that derivative, while the market exposure or notional value of the same derivative represents the total amount associated with that investment.

Even more, a third value called “Holding Delta Adjusted Exposure” (OPFH000500) might be the one that is most appropriate for doing some risk analysis. This value considers that the ‘Delta’ or the price sensitivity of the derivative on changes of the underlying asset usually is less than 1. Hence, the market exposure/ notional values of the holding (OFPH000270, OFPH000275, OFPH000280) shall be multiplied by the ‘Delta’.

Like most ‘Full Portfolio Data’ file as well as the TPT, each asset or instrument of a portfolio is listed in a separate line. However, there are instruments such as various types of ‘Swaps’ that are a combination of two underlying agreements. As those two agreements are usually based on different underlying assets, the question is whether to represent the Swap holding in one line of the Full Portfolio Holding file (one leg approach) or in two lines (two leg approach).

The advantage of the two leg approach is the reduced number of columns needed compared to the one leg approach. What makes it even worse is that in most portfolios the number of this type of derivatives is very small to none, but this approach would create blank columns for all holding positions in the file.

On the other hand, if one puts the two agreements within a Swap into two separate lines (two legs approach) an additional field is needed that links those two lines together. This is the only purpose of the OFPH000205 Holding Grouping Code, which should only be used for this type of derivatives.

Please note that, like the TPT, the openfunds FPH field definitions do not support the one leg approach as this would mean to enlarge the field set quite substantially with fields that needed to be included in the file but would be left empty in the vast majority of transmitted files.

FPH template

An FPH template recommendation can be found here, giving examples of both a “full” template, including more than 90 fields for maximum detail, and a more lightweight “basic” template, using a more minimal set of 24 fields.

Document Information

| Title: | Full Portfolio Holdings |

| Language: | English |

| Confidentiality: | Public |

| Authors: | openfunds (Michael Partin, Charlie Duffin, Birgit Partin) |

Revision History

| Version | Date | Status | Notice |

| 2.2 | 2025-12-15 | Final | Updates resulting from field release 2.12 and release of new TPT version 7. |

| 2.1 | 2024-08-28 | Final | Finalised changes for publishing |

| 2.0 | 2024-06-24 | Draft | Update to add fields for alignment with OFRE as part of working group |

| 1.0 | 2022-09-16 | Final | First version. |

Implementation

If you have any questions about the new data type or difficulties with implementation, please contact us at businessoffice@openfunds.org.

Joining openfunds

If your firm has a need to reliably send or receive fund data, you are more than welcome to use the openfunds fields and definitions free-of-charge. Interested parties can contact the openfunds association by sending an email to: businessoffice@openfunds.org

openfunds.org

c/o Balmer-Etienne AG

Bederstrasse 66

CH-8002 Zurich

Email: businessoffice@openfunds.org

If you wish to read or download this white paper as PDF, please click here.