Dynamic Data – why?

Besides static fund data, which is suitable for submission of current fund information, there is also the need to process another type of data, so-called “dynamic data”. The main characteristic of dynamic data is the ability to store and transmit periodically changing or historical values. Application scenarios for dynamic data are not only fund prices, but also tax data or other information requiring time periods.

Dynamic Data – different code category “OFDY000XXX”

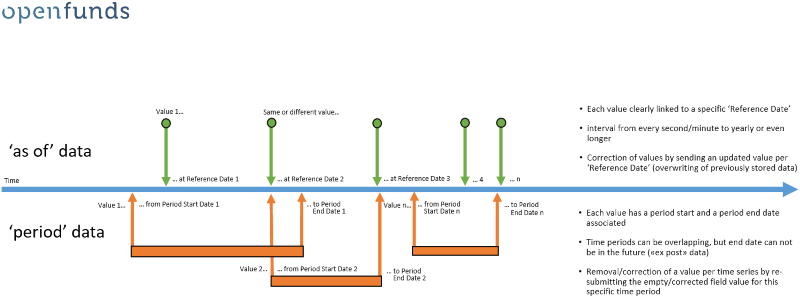

The most significant characteristic of dynamic data is the relation of each value to a specific date or a specific period. Due to this concept, which is different to static data, openfunds has introduced a separate code category, starting with “OFDY”. The concept of dynamic data covers two subsets, the “as of” data and the “period” data. Only the combination of “Value” and “Date” clearly defines a data set in the historical context. For “as of” data, each value is linked to a “Reference Date”, whereas each value of a time period is connected to a “Period Start Date” and “Period End Date”.

“As of” vs. “period” data

“As of” data

Typical data fields of this category are dynamic data values such as Net Asset Values (“NAV”), Asset under Management, Total Shares Outstanding and Dividends etc. A mandatory relation between the actual value and the corresponding date (“Reference Date”) defines all these data fields. To correct values or to provide deletion instructions, openfunds recommends resubmission of the data field with the corrected/empty value and its corresponding date.

“Period” data

Data fields of this type do have a precise period they are valid for. Typical examples are ex-post cost-related data fields (e.g. required by MiFID II). These fields do not use one “Reference Date”, but do have two corresponding date fields, the period start- and end-dates. Please note that generally all period start and end dates of dynamic data, e.g. ex-post data, are in the past.

In theory, “period” data could consist of overlapping or not adjacent periods; nevertheless, in practise most data fields will use the time line to have adjacent sequences. In case of corrections or deletions, resubmission of the corresponding time period with corrected/empty value is recommended.

“OFDY100000 General Reference Date” – lean approach for “as of” data

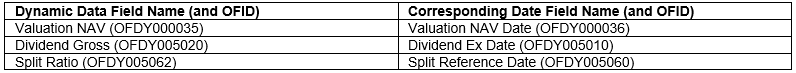

As a fundamental condition, each “as of” data field is linked to a corresponding “Reference Date”, defining when the corresponding value applies (see following table for some examples).

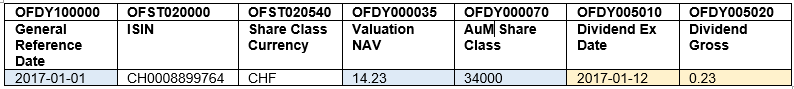

In a regular dynamic data submission, several data fields usually refer to the same “Reference Date”. In the proper meaning of this concept, each data point could be submitted with its corresponding date. Given the fact that this results in redundancy, openfunds has introduced the “OFDY100000 General Reference Date”. It replaces the “Reference Date” information of each data point. Therefore, please keep in mind to use the “General Reference Date” with great care when providing both: “General Reference Date” and the specific “Reference Date” of some fields.

It is possible to mix the “OFDY100000 General Reference Date” and specific Reference Dates. If both dates are used in a submission, the specific date overrules the “OFDY100000 General Reference Date” wherever it is applied (see the following table for an example).

This example shows a use case, which is common practice. Here, the “OFDY100000 General Reference Date” is used as a reference for all values except for the dividend information, because dividends usually do not apply every day and information is often submitted in advance of the “OFDY005010 Dividend Ex Date”). As you may note, the fields “OFDY000036 Valuation NAV Date” and “OFDY000071 AuM Share Class Date” do not need to be provided as the “OFDY100000 General Reference Date” indicates the required reference date.

Due to the complexity of “period” data, the “OFDY100000 General Reference Date” does NOT apply for any data field requiring period start and period end date. All those data fields have to be accompanied by their specific OFDY-fields for period start and period end date information.

Level reference – Fund level vs. Share Class level

Similar to the openfunds static data field range (OFST…), dynamic data can refer to different levels of a fund (fund-, share class- or listing field level). The majority of the dynamic data fields defined by openfunds are on share class level (mostly prices, but also tax data) and require the submission of the corresponding “OFST020000 ISIN”. For certain price data fields on fund level (e.g. “OFDY000060 AuM Fund”), additional static data fields are mandatory (e.g. “OFST010410 Fund Currency”).

Similar to static data, values of fund level fields must be consistent for all share classes within the same fund or sub fund.

Currency related dynamic data

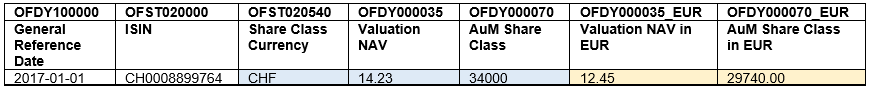

Certain dynamic data points on fund and share class levels are not only linked to a “Reference Date” or a “Time Period”, but are also directly linked to currency information. Similar to the concept of using a “General Reference Date” to avoid unnecessary redundancies, the data fields “OFST020540 Share Class Currency” and “OFST010410 Fund Currency” are used once per line but apply for all currency related values in this line.

In case there is the need to submit additional, currency converted data, openfunds offers the option to apply a suffix to the openfunds field identifier which specifies the currency in which the value is expressed. The suffix consists of an underline (“_”) and the currency code (ISO 4217) (see sample below).

Minor Currencies

In certain cases, monetary amounts related to prices, taxes and dividend information are reported in minor currencies (e.g., GBX, USX, EUX) rather than the standard Share Class Currency (e.g., GBP, USD, EUR).

Whilst there is no specific ISO standard to capture these minor currencies, there is a reference at https://en.wikipedia.org/wiki/ISO_4217#Unofficial_codes_for_minor_units_of_currency to capture this market practice. For values to be expressed in minor units of currency, openfunds recommends replacing the third letter of the ISO 4217 Code of the parent currency with an upper-case “X” (examples: GBX, EUX, USX).

In situations with minor currencies, additional currency fields become relevant:

OFDY000010 Price Currency

If a data transmission uses “OFDY000010 Price Currency”, values in the following fields are expected to be expressed in the specified currency:

- OFDY000020 Bid NAV

- OFDY000025 Ask NAV

- OFDY000035 Valuation NAV

- OFDY000040 Transaction NAV

- OFDY005025 Tax Deducted Reinvested Amount

- OFDY005040 Equalisation Rate

- OFDY005150 Taxable Income per Share EU

- OFDY005155 Taxable Income per Share BE

- OFDY005160 Taxable Income per Share CH

Else, the prices and tax data are expected to be in “OFST020540 Share Class Currency”.

OFDY005000 Dividend Currency

For dividends, if “OFDY005000 Dividend Currency” is not provided, values default to “OFST020540 Share Class Currency”, even if a Price Currency is specified. This affects the following fields:

- OFDY005020 Dividend Gross

- OFDY005022 Dividend Net

- OFDY005100 Taxable Income per Dividend

Here are some price file examples in both formats, narrow and flat file format:

Narrow table (click here to enlarge the picture):

Flat table (click here to enlarge the picture)

Empty field means: “delete”

For transmission of dynamic data, the same concept as for all openfunds transmissions apply: Empty fields means “delete”. For more information, please read the whitepaper “The Ambiguity of Empty Fields”.

Document Information

| Title: | Dynamic Data |

| Language: | English |

| Confidentiality: | Public |

| Authors: | openfunds |

Revision History

| Version | Date | Status | Notice |

| 1.3 | 2025-10-01 | Final | General update, new section ‘minor currencies’ |

| 1.2 | 2024-10-29 | Final | Removed outdated section |

| 1.11 | 2022-03-07 | Final | Added versioning details |

| 1.10 | 2017-10-04 | Final | Updated charts. Added templates. |

| 1.0 | 2017-09-14 | Draft | First version. |

Implementation

If you have any questions about the new data type or difficulties with implementation please contact us at businessoffice@openfunds.org.

Joining openfunds

If your firm has a need to reliably send or receive fund data, you are more than welcome to use the openfunds fields and definitions free-of-charge. Interested parties can contact the openfunds association by sending an email to: businessoffice@openfunds.org

openfunds.org

c/o Balmer-Etienne AG

Bederstrasse 66

CH-8002 Zurich

Email: businessoffice@openfunds.org

If you wish to read or download this white paper as PDF, please click here.